The Spreadsheet Function for Calculating Net Present Value Is

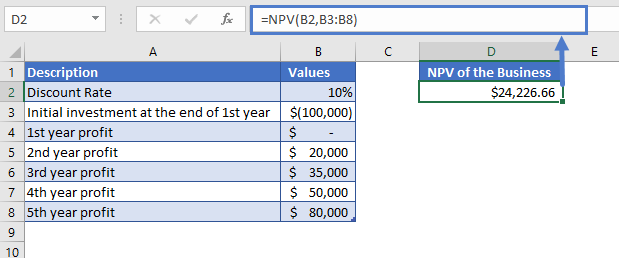

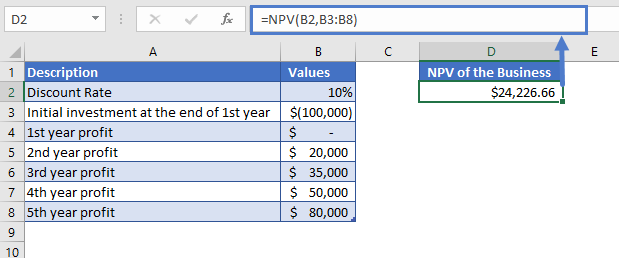

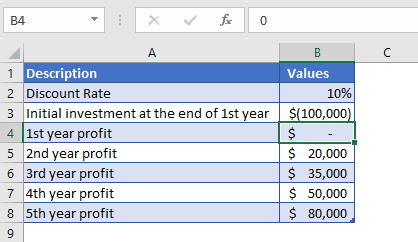

Step 1 Find the present value of the cash inflows. The Excel NPV function calculates the Net Present Value of an investment based on its discounted rate or rate of interest and a series of future cash flows.

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

R Discount range.

. The syntax for calculating Present Value PV is. The formula for Net Present Value is. The syntax of the NPV function is.

The Excel NPV function is a financial function that calculates the net present value NPV of an investment using a discount rate and a series of future cash flows. NPV can be simply stated as the difference between present value of cash inflows and present value of cash outflows. The syntax of the PV function is.

In this usage net means the calculation is. Begin aligned text Present. A positive NPV value indicates that the project is likely to yield profit in future while negative NPV value forecasts the bad return.

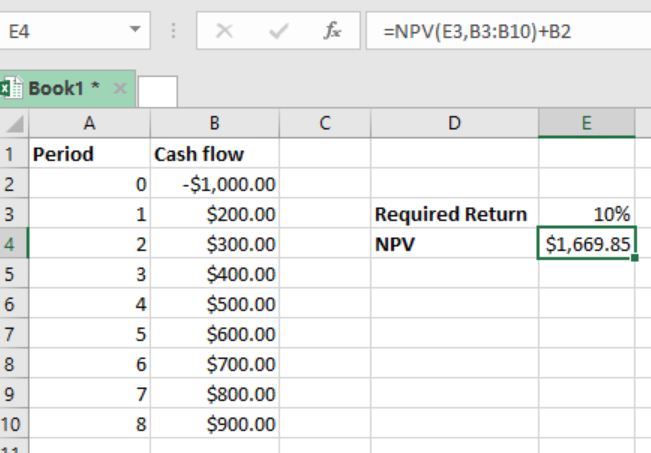

Pmt is the regular payment per period if. NPVCF1 CFn CF0 The NPV is ____ if the required return is less than the IRR and it. The NPV formula helped to calculate PRESENT VALUE of non-fixed cash flow from year 1 to year n.

Present Value Future Value 1 r t. The spreadsheet function for calculating net present value is _____. A guide to the NPV formula in Excel when performing financial analysis.

The spreadsheet function for calculating net present value is. I period number. The NPV function in Google Sheets is categorized under the financial functions Insert Function Financial.

NPV can be easily calculated with our NPV Calculator but that works only if you have the internet connection. - See how to set up the NPV and IRR cash. It is an Excel function and a financial formula that takes rate value for inflow and outflow as input.

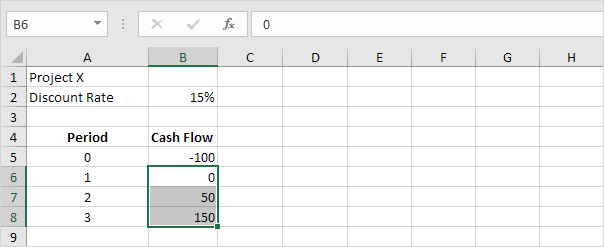

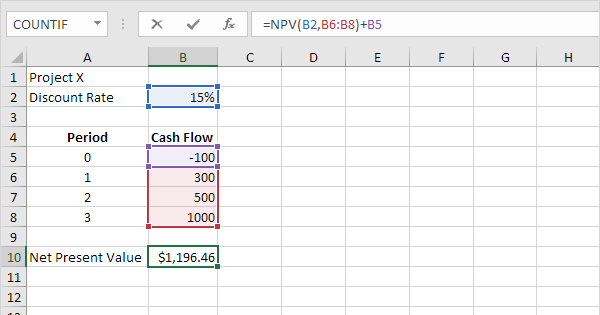

The spreadsheet function for calculating net present value is _____. NPVrateCF1 CFn CF0 Specifying variables in the Excel NPV function differs from the manner in which they are entered in a financial calculator in which of the following ways. For example project X.

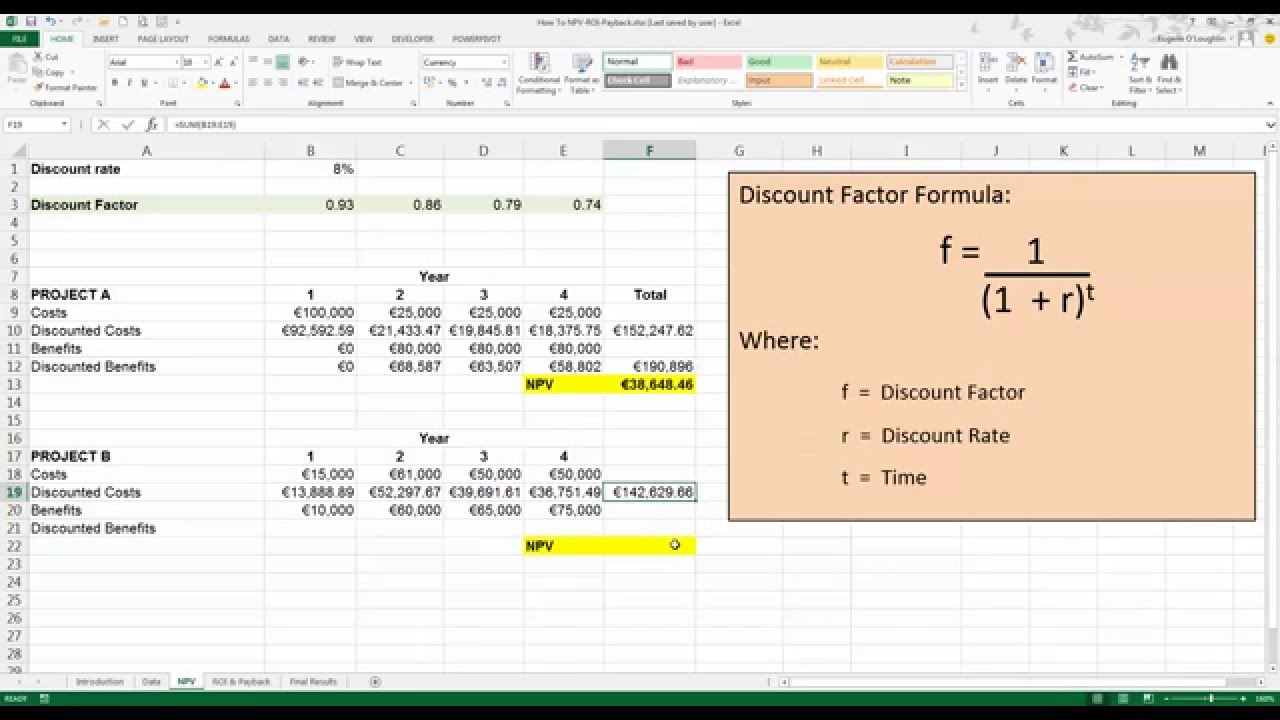

It must be supplied as percentage or a corresponding decimal number. Rate discount rate or interest rate. The formula in cell H2 is using the XNPV where dates are also considered.

The Excel NPV Function uses the following equation to calculate the Net Present Value of the investment. Based on these inputs you want to calculate the net present value using two functions. NPVrateCF1 CFn CF0 Which of the following is a disadvantage of the payback period rule.

Nper is the number of periods over which the investment is made. PVrate nper pmt fv type Open Present valuexlsx and go to the PV workbook or type whats in the screen capture below in your own spreadsheet substituting the numbers for your own values if you wish. Value1 is required whereas value2 onwards are optional.

N number of time periods. Cashflow1 - The first future cash flow. The spreadsheet function for calculating net present value is ____ NPVrateCF1 CFn CF0 The payback period rule ____ a project if ti has a payback period that is less than or equal to a particular cutoff date.

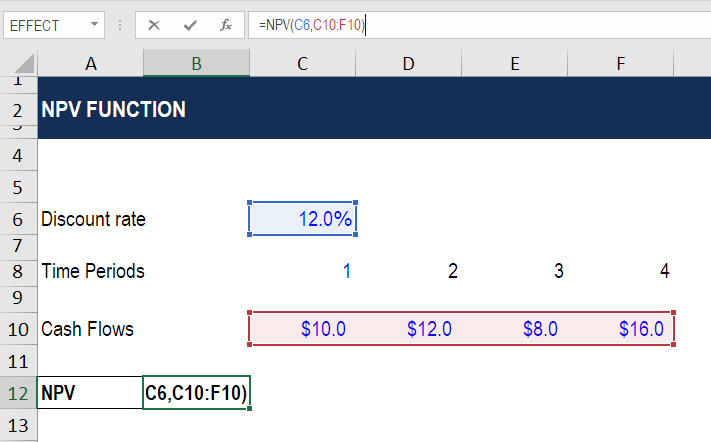

Its important to understand exactly how the NPV formula works in Excel and the math behind it. NPVdiscount cashflow1 cashflow2 discount - The discount rate of the investment over one period. Click cell B10 and enter the function.

Read more template provided. NPV F 1 rn where PV Present Value F Future payment cash flow r Discount rate n the number of periods in the future. Net Present Value Understanding the NPV function.

Therefore the formula structure was NPVinterest ratecash flow year 1 to year n while your fomular also included the investment in year 0. PV rate nper pmt fv type where rate is the interest rate per period as a decimal or a percentage. In lease accounting we use present value to establish the assets or liabilities related to lease obligations or lease receivables.

Since we are looking to get present value based on the projected future value the above formula can be rearranged as. The correct NPV formula in Excel uses the NPV function to calculate the present value of a series of future cash flows and subtracts the initial investment. Z 1 Cash flow in time 1.

Step 3 NPV Calculation 2960652. The formula in cell G2 is for calculating the NPV where we are not considering the dates. Are a series of cash flows at the same regular interval as the rate so if the rate is an annual rate then the cash flows should be a year apart.

NPV rate value1 value2 Rate required - the discount or interest rate over one period. The purpose of the NPV function is to calculate the net present value NPV of an investment. Step 2 Find the sum total of the present values.

For the calculation the function requires or we can say we should input the discount rate and a series of periodic future cash flows. NPVratevalue1value2 where rate is the required rate of return and value1 value2 etc. Calculates the net present value of an investment based on a series of periodic cash flows and a discount rate.

Z 2 Cash flow in time 2. Net present value or NPV is commonly used in capital budgeting decisions and other types of financial analyses as a way to determine the benefit of investing in a particular capital asset. - Add your own custom series andor auto-generate the uniform gradient or exponential gradient series.

This npv function in excel spreadsheets are easy for my professor in question you profit return that net figure on spreadsheet for calculating. 2 The XIRR XNPV Calculator in the screenshot on the right uses Excels XNPV and XIRR functions to calculate Net Present Value and Internal Rate of Return for a non-periodic series of cash flows based on the dates. The NPV function in Excel returns the net present value of an investment based on a discount or interest rate and a series of future cash flows.

How To Use The Excel Npv Function Exceljet

How To Use The Npv Function In Google Sheets

Learn How To Calculate Npv And Irr In Excel Excelchat

Npv Formula In Excel In Easy Steps

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv Definition

How To Use The Excel Npv Function Exceljet

Npv Formula In Excel In Easy Steps

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv Definition

How To Calculate Net Present Value Npv In Excel 2013 Youtube

Npv Formula Excel Calculate The Net Present Value

Formula For Calculating Net Present Value Npv In Excel

Google Sheets Npv Function Calculate Net Present Value Of Investment Google Sheets Functions Youtube

Get The Net Present Value Of A Project Calculation Finance In Excel Npv Youtube

Npv Formula Excel Calculate The Net Present Value

Npv Formula Learn How Net Present Value Really Works Examples

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv Definition

Excel Formula Present Value Of Annuity Exceljet

Comments

Post a Comment