Cost of Preferred Stock Formula

Each share currently sells for 80. In this case the cost of preferred stock 𝑅 𝑝 𝐷 𝑃 0 300 2500 12.

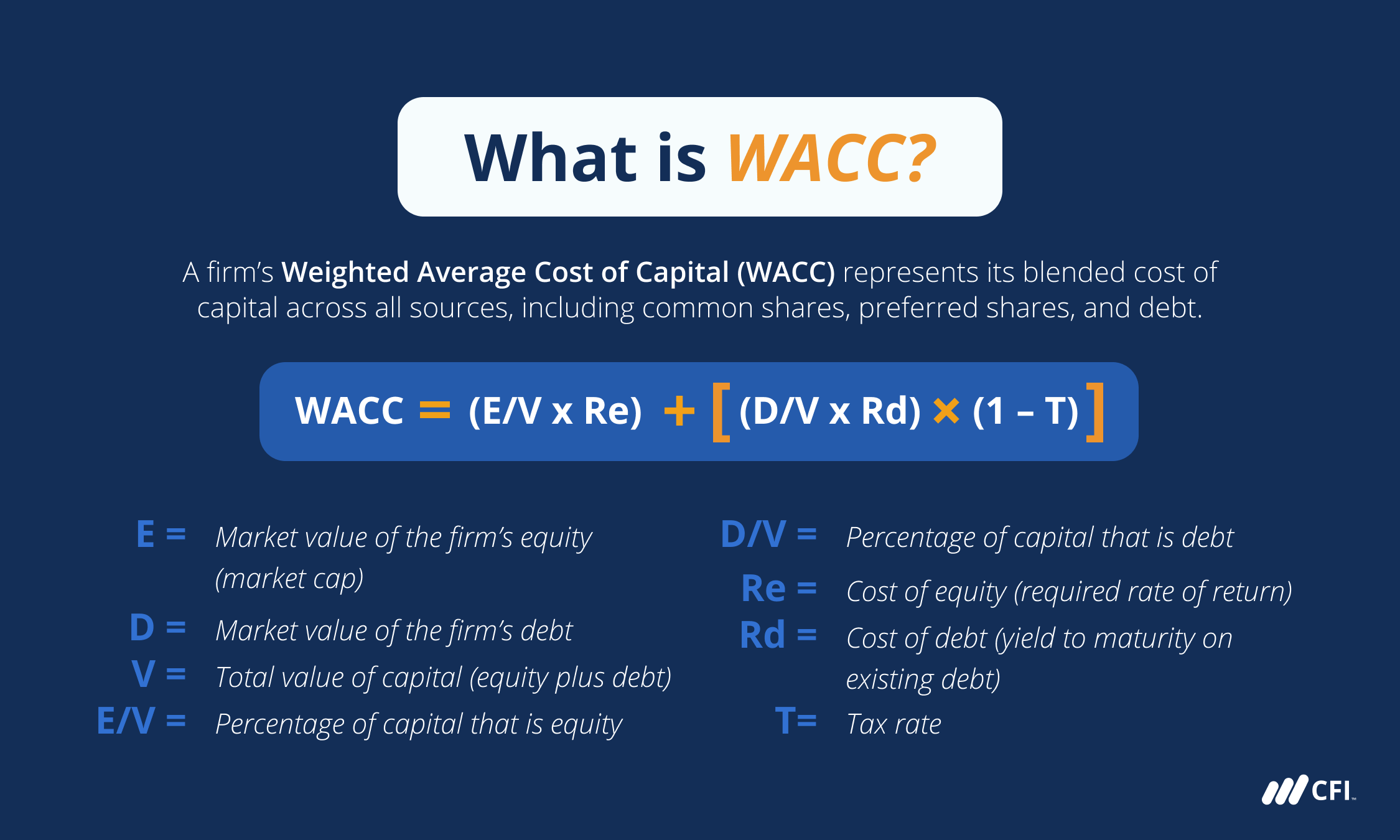

Wacc Formula Definition And Uses Guide To Cost Of Capital

The cost of preferred stock is simple and it is calculated by dividing dividends on preference shares by the amount of preference share and expressed in percentage.

. If they were issued at 20 per stock at 3 dividend rate we can calculate what she is expected to get as dividends using the preferred dividend formula. The cost of preferred stock to a company is effectively the price it pays in return for the income it gets from issuing and selling the stock. The formula used to calculate the cost of preferred stock with growth is as follows.

The current market price of the security is 825. Cost of Preferred Stock 3 25 12. The formula for the.

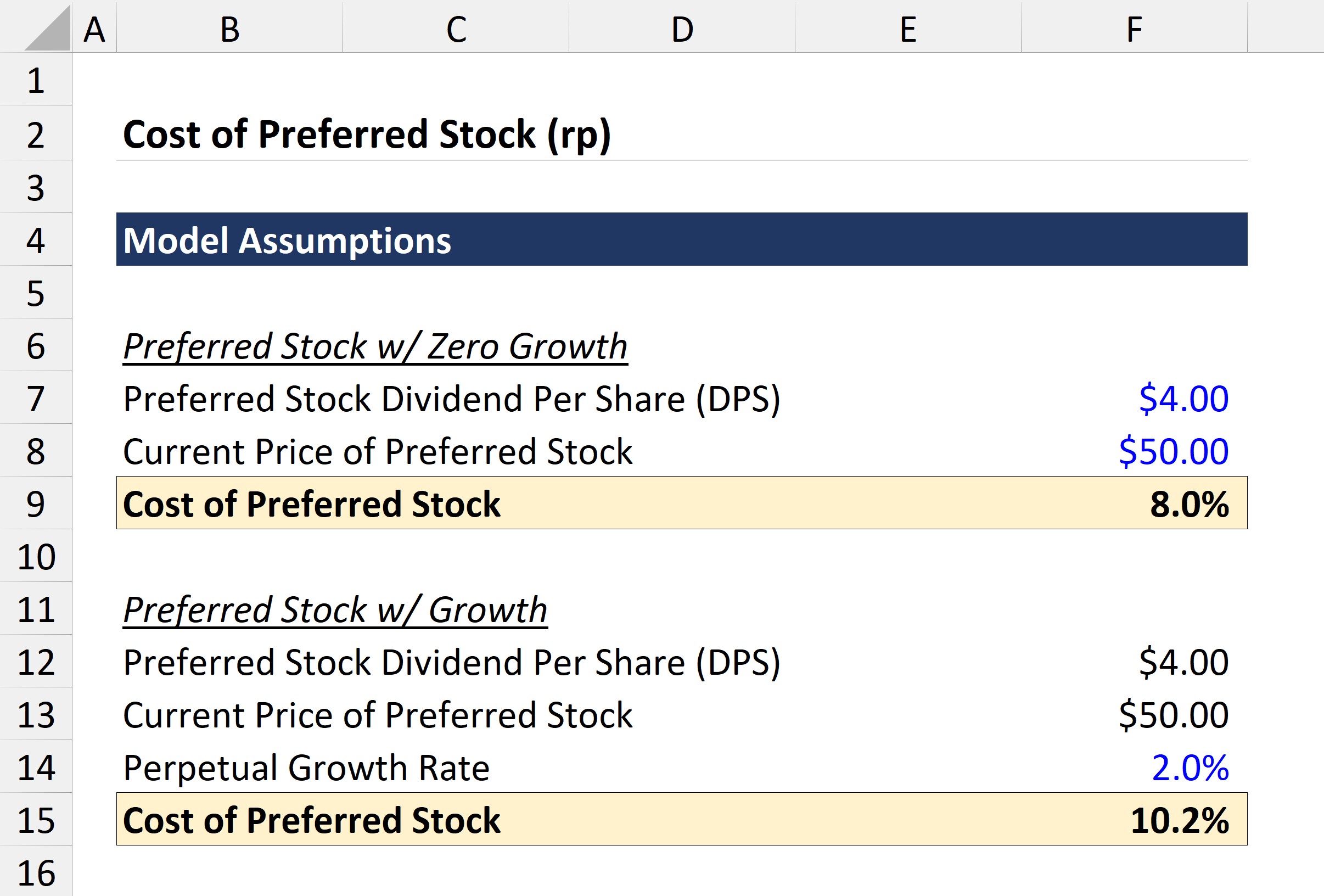

Dividends on Preferred Stock 5. Lets say a companys preferred stock pays a dividend of 4 per share and its market price is. Formula for the CPS is as under.

Formula for Cost of Preferred Stock. So we can calculate the preferred share cost as follows. Want to master Microsoft Excel and take your work-from-home job prospects to the next level.

Net proceeds from issuance of. The cost of preferred stock to a company is effectively the price it pays in return for the income it gets from issuing and selling the stock. Usually the management of a company decides the investment options and chooses the best option of.

Cost of Preferred Stock 400 1 20 5000 20. Annual preferred share dividend 1000 8 80. Preferred dividend Par value x Rate of.

Company A has preferred shares worth dividends of 5 per year. For the calculation inputs use a preferred stock price that reflects the current market value and use. Preferred stock dividends Represents the guaranteed dividend paid to preferred shareholdersA growth rate can be included in the part of the formula.

Current Market Price 80. The formula above tells us that the cost. Jump-start your career with our Premium A-to-Z Microsoft Excel Training Bundle.

Cost of Preferred Stock Preferred stock dividend Preferred stock price. Unlike bonds preferred stock dividend payments are not tax-deductible. They calculate the cost of preferred stock by dividing.

Company A has 2500000 shares of preferred stock outstanding with a 10 face value and an annual fixed dividend rate of 925. Corporate Finance Institute. First we need to calculate the dividend per share per year.

Where the dividend is expected dividend ie. Cost of Preferred Stock D P0. Rps cost of preferred stockDps preferred dividendsPnet net issuing price.

Cost of Preferred Stock for Shares Dividend Market Price. The cost of preferred stock is the dividend yield on preferred equity issued by a company. As the preferred stocks are currently outstanding thus we can calculate the cost of preferred stock by using the below formula.

Calculate the cost of preferred stock. D 20. However the cost of preferred stock still.

The cost of preferred stock is equal to the preferred stock dividend per share DPS divided by the price per preferred share at which the preferred stock was issued as a dividend. It is a component of calculating the companys WACC which has applications regarding the.

Cost Of Preferred Stock Equity Financing In Startups Plan Projections

How To Calculate The Cost Of Preferred Stock Universal Cpa Review

Cost Of Preferred Stock Rp Formula And Calculator

Cost Of Preferred Stock Calculator Calculator Academy

Cost Of Preferred Stock Rp Formula And Calculator

How To Calculate The Cost Of Preferred Stock Universal Cpa Review

Comments

Post a Comment